British fitness convert Susannah Taylor reveals five ways she gets moving even when moving is the last thing she wants to do.

Taylor, the editor of the health hub Get the Gloss, started out exhausted and weary as she worked on the launch of her business.

At one point, she commuted three hours daily, took care of her two kids, and promoted her business.

At a dinner party three years ago she found herself miserable and exhausted from work and commuting.

As Taylor sipped her third glass of wine at a dinner party, she had a conversation with one of her fittest friends about exercise. She became convinced that moving her body would make her feel more alive, less exhausted and less stressed.

Today, she exercises 3 to 5 times a week and she feels great.

Here are the five essential tips for getting off the couch:

1. Start slowly. If you are going running, start by walking fast and then at that moment where your walk breaks into a jog, stay at that pace and you’ll be able to go farther.

2. Exercise even when you don’t feel like it. No one ever regretted a workout, she says.

3. Overthrow the “stay here on the sofa” gremlin who says “It’s cold”; “it’s starting to rain”; “I haven’t got time”, “it’s late”; “I’m tired”; “I’m hungry”; “it’s getting dark.” Go out anyway.

4. Put your trainer outfit and shoes on and walk out the door. You’ll feel really guilty if you then go back inside.

5. Buy some new training clothes. Whether it’s a pair of leggings, a bright new pair of running shoes, or just a vest top, wearing flattering, stylish training clothes inspires you to work out.

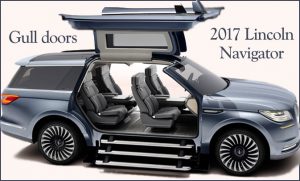

Concept cars are usually shown for years before they go into production.

Concept cars are usually shown for years before they go into production.